By Professor Brian Morgan

My introduction to the Reimagine and Refocus conference briefly outlined the recent ups and downs of the UK economy and made some predictions about where we are likely to be in two years time.

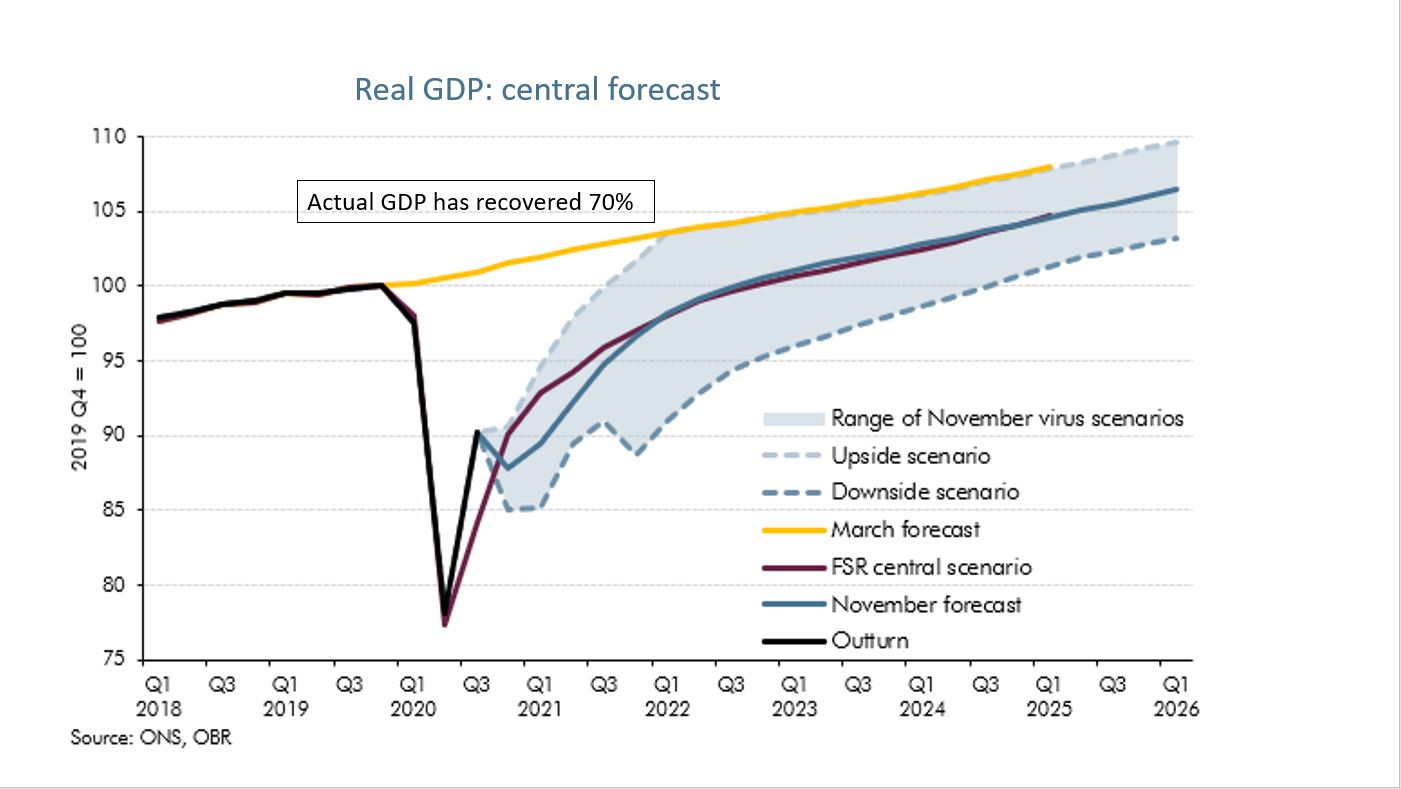

Firstly the slides set out the economic backdrop to the recent recession. They highlight that GDP growth was reasonably good in March 2020, prior to the COVID crisis – indeed GDP growth was ahead of forecasts. Moreover, the foundations of that growth looked fairly solid.

Then came the 20% fall in GDP due to the COVID restrictions – other economic indicators, like employment and retail sales, went in the same direction, as did the FTSE 100 – falling from 7,700 to 5,000, about a 30% fall.

However, the next few slides indicate that the recovery was swift, with a 50% uplift in Q2 2020 and the recovery is now over 70% – with a range of possible scenarios indicated in the graph predicting that we could either be back on trend growth by 2022 (the upside scenario) or still languishing below trend in 2025 (downside).

The FTSE has also recovered to the same degree and because the pre- COVID level of 7,700 did not look over bought, there is a likelihood that it, too, will be back at previous levels when the economy returns to its normal growth trajectory.

The swift upturn in GDP in Q2 along with the other indicators was of course due to a massive fiscal and monetary intervention. The largest budget deficit in history and another huge dose of QE from the Bank of England, along with interest rates being pushed towards zero.

In order to keep the economy growing towards its previous growth path, more of this monetary and fiscal expansion will be required. Certainly the furlough scheme will need to be kept in place along with a continuation of the Universal Credit uplift on the fiscal side and a continuation of near zero interest rates on the monetary side.

The OBR graphs indicate that the peak in borrowing is likely to reach over £400bn – or 20% of GDP. To repay this huge amount in the short term would require a doubling of income tax rates!

However, do we need to repay it? The servicing costs of this debt are extraordinarily low and over half of the debt is held by the BoE. So it’s a strange sort of debt and there is no urgency to repay it. Indeed any attempt to quickly repay the debt would scupper the nascent recovery.

Luckily, I don’t think the Chancellor has any intention of trying to do that but some increases in taxation – e.g. corporation tax and possibly fuel duty – are inevitable over the next year or so.

This should be sufficient to move the budget deficit in the right direction but should not prevent the economy returning to its growth trajectory by the end of 2022.

Brexit is unlikely to derail this return to growth. There will be transition costs and it might cause a more permanent reduction in trade with the EU but the impact will be small relative to either the global financial crisis of 2008 or the global pandemic of 2020.

So the economy is refocusing, it’s a good time to invest in your business, to focus on its core strengths and be in a position to reap the rewards as the economy begins its long journey back to sustainable 2% growth.

View Presentation Slides View Conference Presentation